A Closer Look at the Oil Crisis.

We feel the pinch every time we have to fuel up. Gas prices continue to climb closer to the $3.00 a gallon mark. Yesterday, oil prices alone hit an all time high of $66.00 a barrel, and expected to hit $70.00 a barrel within a week. So what lies in the future of our economy? […]

We feel the pinch every time we have to fuel up. Gas prices continue to climb closer to the $3.00 a gallon mark. Yesterday, oil prices alone hit an all time high of $66.00 a barrel, and expected to hit $70.00 a barrel within a week. So what lies in the future of our economy?

Well while we continue to pay higher prices at the pump, the oil companies continue to post record profits. Yesterday alone, Exxon gained 93 cents a share to close at $60.83, while ConocoPhillips gained 72 cents a share, closing at $66.36. While their stock prices continue to climb, so do their profits. Look at the following posted earnings by the major players in the oil world:

| Company | 2nd Quarter Earnings (in Billions) | Increase From 2q 2004 |

| Exxon | $7.64 | 35% |

| Bp | $5.59 | 29% |

| ConcocPhillips | $3.14 | 51% |

|  |  |  |

|  |  |  |

So while our budgets at home get adjusted and we rapidly curve our spending habits, the oil empires continue to get richer. Good news for the companies and their stock holder, but where does that leave the average American.

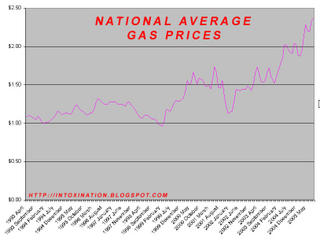

Right now we are paying record prices at the pump. As matter of fact, gas prices are at an all time high, and following the current trend they will continue to jump. The graph below was compiled from data available on the Energy Information Administration’s website.

As you can see, since February 2004, the gas prices have made a constant jump upwards at a dramatic rate.

Now where does this play into affect with crude oil prices. Again referring to the Energy Information Administration’s website, I was able to compile another chart showing the same trends on crude oil prices:

The spikes in prices closely resemble that of the gas prices. Take into consideration the record profits posted by the Oil companies and that shows you how much of your money does go straight to the pocket of oil tycoons.

Congress did jump in on the oil crisis as a way to try and solve the problem. Their solution came in the form of the Energy act which was signed into law this week by President Bush. But will the act help curtail the rising gas prices? The answer is a disappointing no. The act does however give numerous tax breaks to the oil companies, which range in the billions of dollars. They are meant as incentives to try and find new oil supplies closer to home and make their fuel more energy efficient. In the end, it will not help our rising gas prices, but will certainly add to the increasing profits posted by the oil companies.

So where does this leave Joe citizen. Well we feel the crunch at the pump, but will we feel it else where? You can bet on it (that is if you have money to bet with). WLOL TV in Toledo had a report Wednesday of just one way this will affect all of us.

Gas Prices Start to Affect Food Prices

TOLEDO — High gas prices may not only pinch your wallet at the pump but also at the supermarket. Some stores and even restaurants may have to charge more to cover their costs.

Talk about sticker shock. Hal Spradlin couldn’t believe pump prices when he filled up his delivery truck Tuesday morning. Usually $65 gets him close to a full tank. But Tuesday? “Three-quarters of a tank,” Spradlin said. And by week’s end, Hal will nearly pay three times as much. “It’s an average of $180 a week to fill this thing up. Twenty cents a gallon makes a big difference,” said Spradlin.

If you think what Hal pays at the pump doesn’t affect you, you’re wrong. Hal delivers produce for Sam Okun, a food wholesale business in downtown Toledo. Even though the company does not charge extra for gas, the increase cost is built in to the price of some products. “Lettuce that cost us $8 before, we were getting $10 now. We are [selling it for] $10.50. It is affecting the price of the commodity that the customer is buying,” said Neil Bornstein of Sam Okun.

Since shops like Sam Okun sells to both retail stores and restuarants, you could be feeling the pinch of high gas prices at both the pump and dinner table.

Some analysts expect the price of gas to continue to rise. Oil prices hit another all-time high in trading on Monday, with a barrell of crude oil goint for $63.94 cents a barrel. That’s more than three times the price it cost three years ago.

This comes as the US announced it was closing its Embassy and Consulates in Saudi Arabia on Monday and Tuesday because of security threats. There are also continuing concerns that earlier shutdowns of American oil refineries will reduce supply. At least seven US refineries have reported problems of one kind or another in the last two weeks.

Oil prices have risen even though OPEC said Friday that it increased oil production by 300,000 barrels a day in the last two weeks.

Have you seen a good gas price? Want to know what gas prices other people are reporting? Click here to go to News 11’s Gas Watch.

As gas prices rise, so will the reporting stories like this. Something else to consider is local governments and schools. While the prices go up, so does the gas to fuel school buses, police cars, fire trucks, and city work trucks. Local governments are already running in a crisis on their budgets, and this is going to make that crisis even more so. Most likely it will lead to your local officials taking the issue to the ballot box when asking for tax increases or a reduction in city services. Again, something that will hit all of us in the wallet.

So while Bush is vacationing on his Ranch in Crawford Texas and telling us the economy is booming, look deeper into the issue. The economy is booming, but only for the upper 1% of the social ladder. For those of us who are in the middle and lower class income families (the majority of Americans), we will continue to struggle to survive. Our struggle is getting even worse and our spending will curtail as people have to reduce the items they buy for their kids to go back to school. Instead of buying brand name jeans, they will have to purchase generic jeans so they can save a little more to spend at the grocery store. You can be certain Wal-Mart’s profits will also sky rocket at this pace.

The saddest part is the fact that it will continue to make it harder for families to climb the social ladder. Alan Greenspan made a warning a couple months ago that the rising gap between social/economic classes is a threat to our democracy. Nothing could be more true and we needed to address this problem yesterday. Hopefully we can find the answer to it soon. If not, who knows where we will be come winter when people have to start paying for more fuel to heat their homes.