Who Wants To Eliminate Popular Deductions?

The blindness of the right is mindboggling at times. Over at Hot Air, Ed Morrissey has a post up entitled “Taxpayers to Obama: Keep your hands off our deductions”. Here’s what Ed says: In his speech on Wednesday, Barack Obama suggested that eliminating some tax deductions might be necessary to close the budget deficit, at […]

The blindness of the right is mindboggling at times. Over at Hot Air, Ed Morrissey has a post up entitled “Taxpayers to Obama: Keep your hands off our deductions”. Here’s what Ed says:

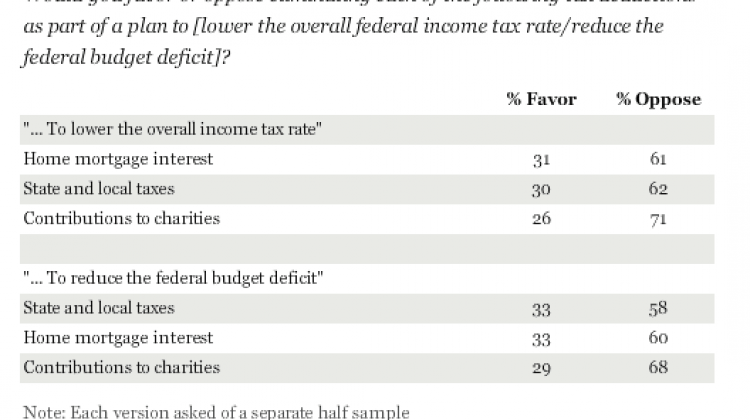

In his speech on Wednesday, Barack Obama suggested that eliminating some tax deductions might be necessary to close the budget deficit, at least on a means-tested basis. Gallup’s latest poll taken after the speech shows the political risk in pushing that idea. Large majorities support the deductions Obama mentioned in the speech, even when told it would help close the federal budget deficit:

But when you look at what part of the Gallup article Ed quotes, you see something totally different:

Americans make it clear they want to keep common federal income tax deductions, regardless of whether the proposed elimination of those deductions is framed as part of a plan to lower the overall income tax rate or as a way to reduce the federal budget deficit. No more than one in three Americans favor eliminating any of the deductions in either scenario. …

Budget plans that call for lower overall tax rates, such as the one proposed by Rep. Paul Ryan, would essentially require that popular deductions be eliminated, basically trading off one tax break for another. President Obama’s commission on deficit reduction last December called for eliminating deductions, including the one for mortgage interest, as part of its plan (ultimately rejected) to reduce the federal budget deficit.

Notice that last paragraph? The GOP plan is also calling for the elimination of the deductions more so than Obama’s.

The poll actually split this question. Half were asked about the elimination of deductions to “lower the overall tax rate” (the Ryan plan) and to “reduce the federal deficit” (the Obama plan). While the results came out rather close, more people favored the idea to support Obama’s plan than did Ryan’s plan:

What this shows is that Americans aren’t as concerned about lower tax rates as they are with reducing the deficit. That pretty much goes against everything the Ryan plan stands for.

And while we are on this subject, one thing has has bothered me with the Ryan plan. The plan calls for a much lower tax rate on the top 1% and corporations, while maintaining the same income levels for the federal government. How can that happen? Well this poll shows how – by eliminating popular tax deductions that benefit the middle class. Our tax rates will still be the same, but our deductions will be lower, while the rich will again see a big savings. This is the GOP’s redistribution of wealth.